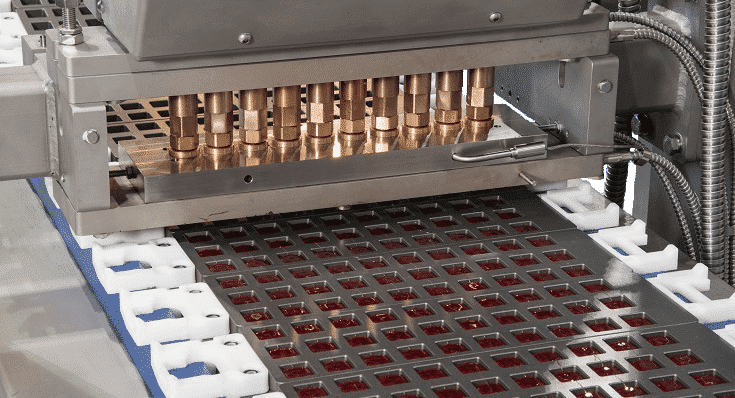

Processing Equipment

Financing

In Partnership With Alliance Funding Group

No-Obligation Quotes

Jump To The Application Portal ↓

Automation Requires Investment

Scale Your Process

Scaling processing equipment will often widen margins drastically but require large up-front investment. For many producers the clear path forward is to find a reasonable lender who is familiar and comfortable with the space.

Over the years we’ve developed a relationship with Alliance Funding Group (AFG), who we’ve come to recommend exclusively. From quick $10,000 to large $30,000,000 loans, AFG allows us to accommodate businesses across a broad spectrum of sizes and credit types.

One-page applications are available for simple loans up to $500,000 as well as custom-tailored financing options for virtually every scenario.

Application-Only

$10,000 – $500,000

Application: 1-page application to review business or credit reports

Term Length: 12-60 months

Buy Outs: $1 Buyout, Fair Market Value, 10% Purchase Option

Payment Types: Monthly, Quarterly, Seasonal, Cash Flow Based Documentation

Equipment Types: Most new or used business equipment, furniture, vehicles, software, etc.

How It Works

- Complete Application through the portal below, including ABM Equipment quote.

- Review Proposal from Alliance (approval typically within 24 hours).

- Return Contracts and receive funds and/or equipment.

Commercial Lease

$500,000 – $30,000,000

Application: Last 3 year-end financial statements & tax returns, current P/L balance sheet

Term length: 24-84 months

Buy outs: Capital Leases ($1 buyout), GAAP Qualified Operating Leases, TRAC Leases and leases with fixed balloon payments

Payment types: Monthly, Quarterly, Seasonal, Cash-Flow Based

Equipment types: All types of business capital expenditures

How It Works

- Contact ABM or AFG via your representative or the form below.

- Send Financial Statements and select preferred terms and structure.

- Wait For Underwriting and sign agreement if appropriate.

- AFG Coordinates with ABM to ensure loan dispersement and equipment delivery align.

Have Questions?

Secure funding quickly, often within 24 hours

Can include installation, service and supply costs

Flexible payment plans

Tax deductions for lease payments under certain conditions

About

Alliance Funding Group

The largest privately held direct lender in the nation, AFG is able to provide more capital, at lower rates, for a wider array of industries than other lenders. Specializing in transactions from $10,000 to $10,000,000, Alliance Funding Group has provided funding for over 15,000 customers since 1998. David Goldstein of AFG has long-standing relationships with many of our customers who have endorsed him to us.

Reputable

More than 15k customers supported

Stable

More than $1.5 Billion financed

Long-Standing

Established in 1998

Fast

Financing in 24 hours or less

Programs

Equipment Financing & Leasing

Finance all types of new and used assets including Tier 1 software (licensing and services). (Terms and pricing are dependent on the credit profile.) Alliance offers all types of lease options including processing equipment, operating, and fixed purchase options. We can also structure the monthly payments to meet your business cash flow needs (i.e. Seasonal, Step-Up /Step-Down, Deferred payments and more).

Working Capital

Up to $5,0000,000 in unsecured working capital to small and medium businesses. Lending volumes are typically between 7-12% of GROSS SALES. The process requires a single-page application, 6 months of bank statements, and the 1st page of your business’ tax returns. The loan is unsecured and preserves your ability to secure additional funding with banks or other lenders.

Structured Financing

Alternative credit options are available for companies that may or may not qualify for traditional financing due to certain credit issues. Alliance maintains portfolios with Moody’s and Standard & Poor’s rated investment companies that offer asset-based lending (including mezzanine, AR Factoring, secured lines of credit, inventory, and contract monetization.)

New Business & Expansion

Funding for new business & businesses with expansion plans is also available. Our financing and leasing programs incorporate 100% cost of the equipment including taxes, delivery, & installation to preserve business cash flow.

Types Of Leases

The Fair Market Value Lease (OPEX)

Fair Market Value leases offer the lowest monthly payments and may qualify as an operating expense for tax purposes. Fair Market Value payments are true rental payments. When the lease ends, you can return the equipment, continue to lease it month-to-month, or purchase it at it fair market value.

The 10% or 20% Purchase Option Lease (capital lease with fixed purchase option)

This lease has a slightly higher monthly payment but offers the security of a fixed purchase price at the end of the lease, 10% or 20% of the original purchase price. Any time the purchase option is fixed, it increases the likelihood that the lease will be treated as an installment loan for tax purposes. The major test is whether 10% or 20% of the original purchase price represents a “bargain purchase price.” You should consult with your accountant for a final recommendation.

The Dollar Buy-Out Lease (CAPEX)

This lease is similar to a loan. The processor owns the equipment, makes monthly payments to the leasing company, and can usually take advantage of tax benefits such as interest deductions and depreciation. At the end of the lease term, the customer simply pays a $1 buyout and the equipment is theirs with no further obligation.

Types Of Leases

The Fair Market Value Lease (OPEX)

Fair Market Value leases offer the lowest monthly payments and may qualify as an operating expense for tax purposes. Fair Market Value payments are true rental payments. When the lease ends, you can return the equipment, continue to lease it month-to-month, or purchase it at it fair market value.

The 10% or 20% Purchase Option Lease (capital lease with fixed purchase option)

This lease has a slightly higher monthly payment but offers the security of a fixed purchase price at the end of the lease, 10% or 20% of the original purchase price. Any time the purchase option is fixed, it increases the likelihood that the lease will be treated as an installment loan for tax purposes. The major test is whether 10% or 20% of the original purchase price represents a “bargain purchase price.” You should consult with your accountant for a final recommendation.

The Dollar Buy-Out Lease (CAPEX)

This lease is similar to a loan. The processor owns the equipment, makes monthly payments to the leasing company, and can usually take advantage of tax benefits such as interest deductions and depreciation. At the end of the lease term, the customer simply pays a $1 buyout and the equipment is theirs with no further obligation.

Faq

What's the turnaround time?

One-page applications, (up to $500,000) can be approved within a few minutes, typically no longer than four hours, and seldom more than 24. The most common turn-around time is about two hours.

What do I need to get credit approved?

For a one-page application, just a completed credit application & vendor quote is required. For a full-sized loan you’ll need your last 3 year-end financial statements, 3 tax returns, and current P/L balance sheet.

Can the loan cover equipment not provided by ABM?

Yes, you can buy new or used equipment, processing or otherwise, from any supplier and negotiate the final pricing.

What's the buy out?

There are numerous options available for a buy out. These include Fair Market Value (FMV), $1 Buy-Out, and Fixed Percentage Purchase options.

What kinds of equipment can be leased?

Whatever you can justifiably use for your business, we can finance. We have a variety of programs for new and used processing equipment. We can even finance software, fixtures, and installation costs.

What are your rates?

Rates depend on the size of the credit request, lease/loan structure, and the underlying credit of your customer. There is a risk-based pricing within the underwriting process. The lower the risk, the lower the lease rate can be. That being said, AFG is the largest privately held direct lender in the States and can offer the best rates for many industries, but especially processing.

Do you offer line-of-credit for future purchases?

Yes; AFG provides lease lines of credit (also known as master leases) where a predetermined amount is preapproved. That way you can purchase equipment in the future without paying interest on unused portions of the loan.

Do you do cash loans/working capital?

Yes; Alliance has a range of different working capital options. The working capital loans range from $5k to $5,000,000.00.

What info do I need to get working capital?

You need 6 months of complete bank statements and to fill out the single page credit application.

Contact Us

Ask a question or get started.

"*" indicates required fields

Visit Us

13911 NW 3rd Ct.

Vancouver, WA 98685

Contact us

(503) 248-0711

frontdesk@abmequipment.com

Open Hours

M-F: 8am – 5pm